Artificial intelligence (AI) is set to change how we handle money. By 2025, it could do most routine financial tasks. Dave Antrobus, from Inc & Co, is leading this shift. He combines AI with new financial ideas to improve how we manage our money.

Dave Antrobus is well-known in financial tech. He uses cutting-edge AI for big changes in personal finance. His approach brings together AI and new financial tactics. This effort is making waves in the UK and elsewhere. Dave’s work means better tools for everyone to manage their finances, creating a new industry standard.

The Vision of Dave Antrobus in Personal Finance

Dave Antrobus is a top name in finance, leading with new ideas on using AI. He aims to change personal finance, making it smarter and more tailored to each person. This move could revolutionize the way we manage our money.

His work in bringing advanced tech into the UK’s finance scene is key. By blending AI into finance, he strives to offer tailored financial guidance and solutions. This isn’t just for convenience. It’s about making finance easy and smart for everyone.

Antrobus’s focus on AI marks a big step towards a new financial age. He uses AI to make understanding and handling our money much simpler. His efforts ensure the UK is a leader in financial tech, ready for the future.

How AI is Revolutionising the Personal Finance Sector

Artificial Intelligence (AI) is changing how we handle money, making everything smarter and more personalised. It automates tasks, predicts trends, and tailors financial advice to each person’s needs. This AI Disruption is improving credit scores, spotting fraud, and helping with budgeting. It’s changing finance for the better.

More people are using AI-driven finance apps than ever, thanks to their ease and accuracy. For example, Jio Financial in India uses AI to offer personalised services to its massive user base. They aim to make finance easy for everyone, even in less urban areas.

AI has sped up loan processes, making customers happier by getting them funds faster. It’s also making investment advice more personal, leading to better decisions. This shows how tailored advice can really help people.

AI is fighting online fraud too, by constantly checking transactions for anything odd. Tools like Xero’s JAX assistant offer smart help and improve over time. This keeps both money and personal data safer.

AI is also cutting costs for banks by taking over routine jobs. This lets people work on bigger goals and makes the whole sector more efficient. New AI technologies are getting even better at understanding various types of data.

In the workplace, AI like Amazon’s AI assistant, Amazon Q, proves that it can make teams more productive. Even small companies, like Mindtrip, are using AI to create unique travel services. It shows AI’s power isn’t just for finance but can improve all sorts of businesses.

Integration of AI in the UK Financial Market

The UK’s financial market is on the brink of major change, thanks to AI. Dave Antrobus is leading the way, using AI to make banking smarter and more secure. This breakthrough is putting the UK at the forefront of global finance innovation.

AI is changing how the UK’s financial sector operates, making things faster and more user-friendly. For example, Jio Financial in India shows the way. It uses AI to reach people in far-off places. This could soon be a reality in the UK, giving more people access to financial services.

AI is also making the UK’s financial market safer. It does this by improving how we protect data. Following Jio’s lead in security could help the UK fight against the growing problem of data theft. The hacking of 170 million records in Russia in 2023 shows how important this is.

The UK is quickly adopting AI in finance, leading to big changes. This new approach will make finance more open to all. The UK is becoming a leader in using AI for finance. The goal is to create a safe, fast, and welcoming financial world for everyone.

AI and Personal Finance: The Future of Banking in the UK

In the UK Finance world, artificial intelligence is changing the game. This AI Advancement makes bank services better and easier for customers. Banks now talk to their clients in a smoother and more efficient way.

Automated financial advice is a big change. Banks use smart tech to give customers personal advice on money matters. This helps people make smart choices about saving, investing, and spending.

Future Banking also includes checking risks quickly. AI tools look at patterns to spot financial dangers early. This way, banks can keep everyone safer from fraud and other issues.

Chatbots and virtual assistants make customer service better too. They answer questions fast, improving customer happiness. This service is available 24/7, so banking clients get help whenever they need it.

Antrobus’s work shows how AI and finance are coming together for a new banking era. AI is making customer service better, operations smoother, and keeping money safe. With ongoing AI Advancement, the future of Future Banking in the UK looks very promising.

Dave Antrobus: A Pioneer in Financial Innovation

Dave Antrobus is known for his incredible work in the finance world. He’s focused on creating financial solutions using AI. These include smart investment tools and financial systems that put users first. His aim is to use the latest technology to make managing finances easier and better.

He’s passionate about bringing AI into finance, changing the industry for the better. His work has made handling money simpler and more customised for everyone. This blend of tech and finance shows why he’s at the forefront of financial innovation today.

Personal Finance Tools Enhanced by Artificial Intelligence

Recently, AI has changed how we handle money. Smart apps use clever algorithms for easier investing, saving, and budgeting. This makes managing money simpler.

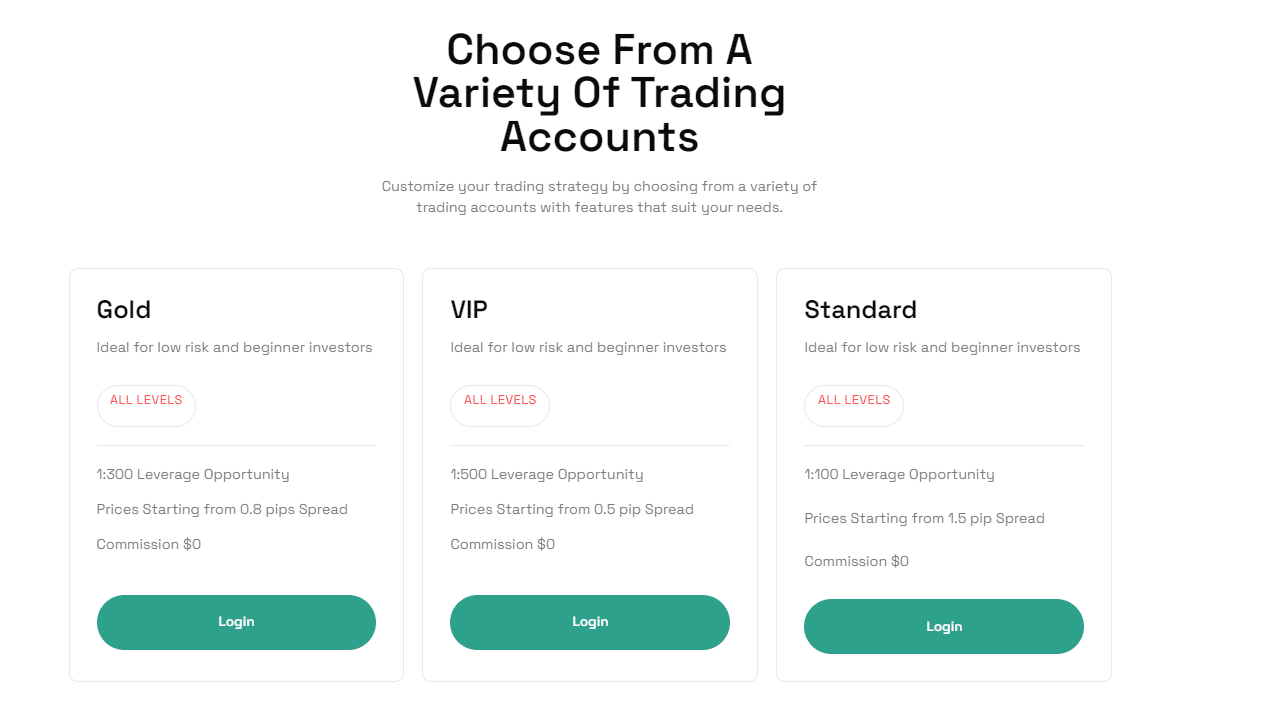

There are different levels of AI finance tools, from £30 to £65 a month. Each level offers access to global news, expert advice, newsletters, and more. The top tier even includes full access to Financial Times online, expert analysis, and paper delivery.

These tools also offer a yearly payment option with a 20% discount. This encourages long-term financial planning, improving management of personal finances.

Last week showed how quickly stock markets can change. The S&P 500 dropped 2.5%, the Nasdaq 3.6%, and the Russell 2000 nearly 7%. AI tools help investors stay steady by predicting market movements.

Big tech companies like Microsoft, Meta, and Google have invested over £32 billion in AI technology. This shows how important AI is becoming in finance. Companies like Nvidia, that make AI chips, are growing fast.

AI in finance isn’t just about smart choices; it’s about a complete set of tools for economic management. These apps are continuously improving, offering better ways to understand and manage finances.

Real-World Applications of AI in Personal Finance

AI changes how we handle money day-to-day. Now, people can talk to chatbots for quick answers to money questions. This makes things easier and faster. Big banks are using this tech, so customers get help and advice right away. This cuts down on the wait and confusion.

Robo-advisors are a great example of innovation in personal finance. They look at market info and your financial goals to suggest how to invest. This opens up expert investing advice to many more people. Now, not only the wealthy can get help managing their investments.

AI plays a big role in stopping fraud too. It keeps an eye on transactions 24/7 to catch any strange activity. Big companies like Microsoft, Meta, and Google have poured $40.5 billion into AI tech. This shows they’re serious about using AI to keep our financial information safe.

In addition, AI is helping society in bigger ways. For example, Ottawa is using AI to predict who might become homeless. It looks at lots of data, including the weather and economy, to figure out who needs help. This could mean getting the right support to those who need it most. Despite worries about AI making biased decisions, there’s a positive trend. More people are benefiting from this tech.

The world of personal finance is being transformed by AI. It’s making services better, keeping our data safer, and helping everyone. With AI, the future looks brighter for managing our money.

The Role of AI in Addressing Financial Literacy

Educational AI plays a key role today in boosting financial literacy. It helps people make smart money decisions more confidently. These powerful technologies have changed how we learn about and manage our money. They turn tricky financial ideas into simpler concepts and offer personalized learning.

AI in financial education brings a new, interactive way to learn. It creates special learning platforms just for you. For example, AI tools can look at how you spend money. Then, they give advice tailored to help you budget, save, and invest better. This means the advice you get fits your own financial situation perfectly.

Also, learning about money through technology is fun and easy. It includes quizzes, games, and simulations from real life to teach you. With AI, these programs change to match your learning speed and what you understand. This way, you get a full understanding of the topic.

AI platforms offer up-to-date, practical financial tips, unlike old-school ways. They clear up the confusing parts of finance, making it easier for everyone to get. This opens the door to better financial know-how for more people. So, folks can handle their money better, from everyday budgeting to planning for retirement.

The Potential Risks and Ethical Issues of AI in Finance

Artificial intelligence brings many benefits to finance, but it also has challenges. A major issue is the risk of data security breaches. Financial Data Security is crucial because losing or misusing sensitive data can severely affect people and institutions. As AI becomes more integrated, it’s vital to protect this information.

Ethical AI Concerns are also a big problem. AI systems can accidentally make existing biases worse by using biased data in their algorithms. This can unfairly harm certain groups, damaging the trust in financial services.

Using AI in finance creates operational risks too. It allows tasks to be done without humans, making processes more efficient and saving money. Yet, this could mean fewer jobs, raising ethical questions about workers’ futures.

Companies such as Microsoft, SAP, and Oracle are investing a lot in AI to improve their financial products. However, despite the benefits like better efficiency, we need strict rules to govern AI’s use. The Spanish Agency for AI Supervision and new EU laws show we’re moving towards better control.

By 2025, there will be a ban on AI uses that aren’t acceptable, showing the need for ethical guidelines and openness. From August, large AI models must follow best practices to handle Ethical AI Concerns. By 2026, the EU wants systems in place to check high-risk AI before it hits the market.

Industry leaders are developing AI to predict market trends and what customers want. This helps finance companies become more proactive. Still, it’s key to match innovation with ensuring user safety to truly benefit from AI in finance.

Conclusion

Dave Antrobus‘ work with AI in finance has truly changed the game. His Antrobus AI Initiative is making big waves in the UK. By bringing AI into finance, he’s made it easier for people to understand and manage their money. This is a big step forward in Financial Technology.

The benefits of AI in finance are huge. It gives us tailored advice, tracks spending instantly, and spots fraud quickly. But, as we embrace these advancements, we must not forget about ethical responsibility. Making sure AI in finance is safe and fair is just as important. We need to stay alert to any risks.

The UK is at the forefront of applying AI in finance, thanks to the Antrobus AI Initiative. This movement shows how AI can change the way we handle our money worldwide. But, as we move forward, we need to keep talking and checking that these changes are good for everyone. Balancing innovation with ethics is key to the future of financial technology.

Next morning’s breakfast was also very agreeable. Locally-sourced fruit salad with a mint compote for myself, while my partner demolished smoked salmon and scrambled eggs, accompanied by sauteed baby spinach. All served with a smile and a very warm welcome. Every day should start like this!

Next morning’s breakfast was also very agreeable. Locally-sourced fruit salad with a mint compote for myself, while my partner demolished smoked salmon and scrambled eggs, accompanied by sauteed baby spinach. All served with a smile and a very warm welcome. Every day should start like this!