In the modern financial landscape, the difference between a successful trade and a missed

opportunity often comes down to milliseconds and metadata.

As we move further into 2026, the reliance on basic & live equity data software; is no longer enough to maintain a competitive advantage. To succeed, traders must look beyond simple price action and into the very fabric of market microstructure.

This guide explores the evolution of real-time share market platforms, the necessity of

high-fidelity data, and why Bookmap has solidified its reputation as the best tool for

visualising the invisible forces of the stock market.

Table of contents

1. The Shift from Static to Dynamic Data

2. Decoding Live Equity Data Software: Level 1 vs. Level

3. Why Bookmap is the Best for Order Flow Visualisation

4. Analysing Bookmap Reviews: What the Pro Community Says

5. Technical Infrastructure: Low-Latency and High Frame Rates

6. Listicle: 5 Reasons Bookmap Dominates Real-Time Analysis

7. Comparing the Giants: Bookmap vs. Traditional Analytics

8. Conclusion: Investing in Your Infrastructure

1. The Shift from Static to Dynamic Data

For decades, retail traders were satisfied with instant stock price monitoring tools that

provided a simple ticker and a candlestick chart. These tools tell you where the price is, but

they fail to explain why it is there

In the era of financial market analytics software, data is no longer just a number; it is a

map. Professional firms use investment research technology to track the intent of other

participants. If you are still using static charts, you are essentially flying a plane with only an altimeter, while the professionals are using 3D radar. This is where advanced trading

infrastructure solutions become vital.

2. Decoding Live Equity Data Software: Level 1 vs. Level 2

When searching for real-time stock trading tools, the first clarification is usually: What kind

of data do you actually need?

● Level 1 Data: Provides the basic NBBO (National Best Bid and Offer), last price, and

daily volume. This is sufficient for long-term investors but woefully inadequate for

active traders.

● Level 2 Data (Market Depth): Shows the full range of buy and sell orders waiting to

be executed. This is the fuel for live stock market data systems.

Without a tool like Bookmap, Level 2 data is just a flickering wall of numbers (the DOM) that is impossible for the human brain to process in real-time. Bookmap takes this raw data and converts it into a color-coded heatmap, allowing you to see the gravity of large orders

before the price ever reaches them.

3. Why Bookmap is the Best for Order Flow Visualisation

If you ask professional order flow traders to name the best platform for seeing the market’s

true intent, Bookmap is almost always the answer. It doesn’t just display data; it tells a

cinematic story of the auction process.

While other real-time share market platforms try to overlay indicators on top of price,

Bookmap focuses on the Heatmap. This heatmap records the history of the limit order

book. You can see when a large institutional buyer enters the fray, how they move their

orders to chase; price, and when they suddenly pull their liquidity (spoofing). This level of

transparency is why Bookmap is considered the gold standard in real-time financial

instruments tracking.

4. Analysing Bookmap Reviews: What the Pro Community Says

To understand the impact of a tool, one must look at the user base. Bookmap 500+ reviews across major platforms like Trustpilot and specialised trading forums highlight a few recurring themes:

● The ‘Aha!’ moment: Many Bookmap reviews mention that after years of struggling

with technical analysis, seeing the heatmap made the market finally make sense.

● Reliability: In the world of low-latency trading data providers, stability is king.

Bookmap reviews frequently praise the platform’s ability to handle massive data

bursts during high-volatility events (like FOMC meetings or earnings) without lagging.

● Educational Ecosystem: Users often point to the Trader’s Lab as a reason why

Bookmap is the best all-in-one solution. It isn’t just software; it’s a community of

professionals teaching you how to read the footprints of giants.

With a consistent 4.5+ star rating, the consensus is clear: for serious traders, the

subscription is an investment in clarity.

5. Technical Infrastructure: Low-Latency and High Frame Rates

The technical specification of your trading tools matters. Most web-based stock trading

tools with real-time market data refresh at 1-second intervals. In high-frequency

environments, a second is an eternity.

Bookmap is engineered for bulge bracket bank trading desks levels of performance,

delivering up to 40 frames per second. This ensures that when you see a Volume Bubble;

(a visual representation of a trade), it is happening now, not three seconds ago. This high-

refresh rate is critical for identifying high-frequency institutional arbitrage and other

algorithmic footprints that disappear as quickly as they appear.

6. 5 Reasons Bookmap Dominates Real-Time Analysis

1. The Heatmap (Historical Depth): Unlike a standard DOM that only shows the current orders, Bookmap shows where orders were. This allows you to identify ‘sticky’ liquidity levels that institutions have been defending for hours.

2. Volume Bubbles: These provide a three-dimensional view of trades. The size of the

bubble represents the volume, and the color indicates whether the buyer or seller

was more aggressive.

3. Iceberg Detection: Bookmap is arguably the best tool for unmasking and hidden

orders. Its proprietary algorithms detect when a large participant is slicing; an order

to hide their true size.

4. Multi-Asset Flexibility: Whether you are trading US Equities, Futures, or Crypto,

Bookmap integrates with top-tier data providers like dxFeed and Rithmic to provide

a unified view.

5. Custom Indicators: From ‘Large Lot Trackers’ to ‘Stop Run Probes’ Bookmap

allows you to filter out the noise and focus exclusively on the ‘Smart Money’.

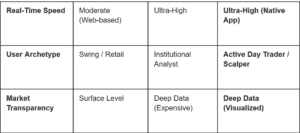

7. Comparing the Giants: Bookmap vs. Traditional Analytics Feature

While TradingView is excellent for scanning and Bloomberg is the king of news, Bookmap

occupies a unique niche. It provides the visual depth of an institutional terminal but at a price point and usability level accessible to the dedicated retail trader.

8. Conclusion: Investing in Your Infrastructure

If you are serious about professional firm trading, you cannot rely on amateur tools. The

market is a zero-sum game where the participants with the best information win.

Choosing Bookmap means choosing to see the market without the lag of traditional

indicators. It means understanding the auction, identifying the liquidity, and trading with the confidence that comes from seeing exactly where the big players are positioned.

As demonstrated by thousands of Bookmap reviews, this isn’t just another charting tool – it is one of the best investments a trader can make in their own execution infrastructure.

In 2026, don’t just watch the price. Watch the orders. Watch the intent. Watch the market live on Bookmap.

Ready to Level Up?

To get started with real-time stock trading tools, you could explore the Bookmap trial alongside a high-quality data feed like dxFeed. See for yourself why the most successful traders in the world have moved away from candlesticks and toward the Heatmap.