Money Wellness has unveiled a free Christmas Debt Calculator that shows how long festive borrowing might take to repay and how much interest could accumulate over time.

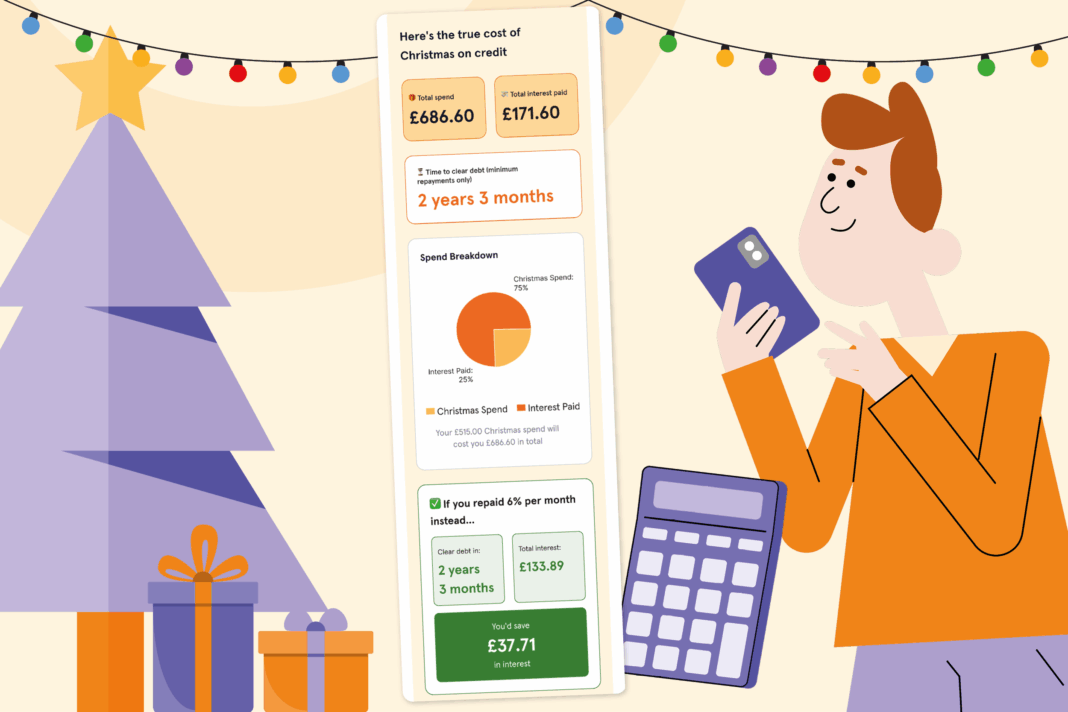

The calculator – available at www.moneywellness.com/christmas-debt-calculator – is designed for quick use. Users simply enter their Christmas spending and credit card repayment details, and the tool instantly reveals repayment duration, total interest, savings from paying more each month, and a visual progress graph.

Data from Money Wellness suggests borrowing pressures are intensifying. Sixty per cent of customers now have outstanding credit card balances averaging £5,000, compared with 57% and £4,000 last year. The number of people requesting BNPL-related help has risen by 44% over the past year, with October 2025 seeing the highest recorded volume of requests. A further spike is expected in January and February 2026 as Christmas debts surface.

With household bills still squeezing budgets, many families find themselves turning to credit and relying on minimum repayments, which can prolong debt for years.

As an example, a family who places £1,000 of Christmas spending on a credit card at 29.9% APR and pays only the 3% minimum each month could face an 8–10 year repayment period, with interest charges totalling around £700–£1,000.

Sebrina McCullough, External Affairs Director at Money Wellness, said: “Black Friday is nearly here, and lots of people are getting ready to spend on presents, food, travel, and decorations. But with household bills still high, many are being forced to rely on credit cards or Buy Now Pay Later (BNPL) to cover festive spending – and some could be paying off this year’s Christmas debt well into the 2030s.

“The problem is the interest, especially if you can only afford minimum repayments.

“Our calculator gives people a clear, personalised picture of how long Christmas spending could take to clear. It’s simple, practical, and designed to help people make informed decisions before the shopping rush begins.

“If anyone is worried about money or struggling with credit cards, BNPL, or other bills, we’re here to help and our support is completely free.”

The Christmas Debt Calculator enables users to total their festive spending, adjust APR and repayments, see a personalised debt timeline, compare interest outcomes, and access free budgeting tips and debt advice.

The free calculator can be accessed at www.moneywellness.com/christmas-debt-calculator.