UK consumer lender Evlo has confirmed a strategic partnership with Moneyline to improve access to affordable finance for non-prime applicants, particularly during periods of urgent need.

Although many people apply to Evlo each month, some fail to meet its lending requirements. This partnership ensures that such applicants will be referred to Moneyline, a not-for-profit organisation specialising in small, low-cost loans for individuals most at risk of financial marginalisation.

“We know that not everyone who applies for credit with us will be eligible, but we believe in doing right by every customer,” said Asif Nadeem, Chief Transformation Officer at Evlo.

“This partnership means that even when we can’t lend, we can still point customers toward helpful, trusted resources — like those offered by Moneyline — that may support them on their financial journey.”

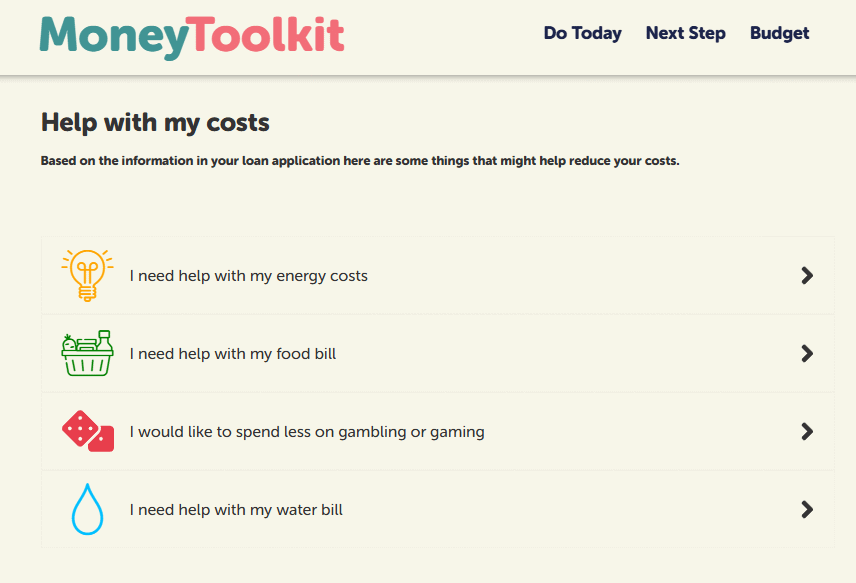

For customers where credit isn’t the solution, customers will gain access to Moneyline’s MoneyToolkit — a free digital hub offering budgeting tools, gambling support, cost-saving tips, and an embedded benefits calculator that helps individuals identify unclaimed government support they may be entitled to. This toolkit is designed to empower customers to take control of their finances, improve their financial resilience, and reduce reliance on credit for essential needs.

“This partnership is about shared values,” added Shiona Crichton, CEO at Moneyline. “Evlo is acknowledging that a customers ability to afford the loan and provide a good outcome comes first and, by working with us, they’re helping customers take control of their financial journey even if it starts in a different direction.”

With rising costs of living and ongoing barriers to mainstream credit, non-prime and underserved households often turn to unregulated or harmful lending alternatives. By working together, Evlo and Moneyline aim to offer a safer, supported route, ensuring that people don’t fall through the cracks simply because of where they are on the credit spectrum.

Together, Evlo and Moneyline are demonstrating how collaboration between commercial and social lenders can improve access to credit, protect vulnerable consumers, and promote financial inclusion at scale.