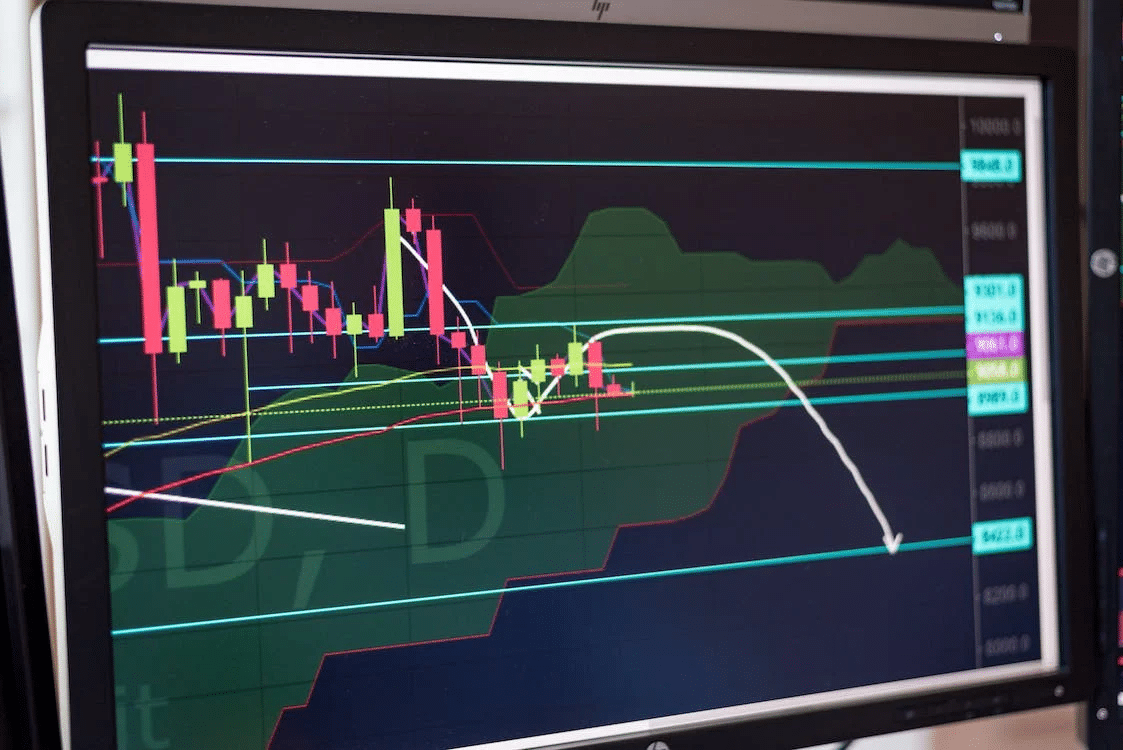

The death cross is a technical analysis pattern that can be used to predict the future direction of an asset’s price. It indicates that the trend may have reversed, and a downtrend will likely follow. The crossover occurs when the short-term moving average falls below the long-term moving average, such as in the example below.

To use this pattern for binary options trading, you should wait for an appropriate confirmation signal before entering any trades. Some traders also wait for the price to confirm movement after crossing over into bearish territory by closing at or near its low point for two consecutive candles or hitting resistance levels. You could also use technical indicators such as Bollinger Bands to help with your entry points. Take a closer look at some key factors you’ll need to consider when making trading decisions using this pattern.

Advantages of Using a Death Cross Pattern

The death cross is a powerful trading pattern that can help you find good entry points for short-term binary options trades. Since it occurs when an asset breaks down from a long-term support level, the odds are stacked in your favour to make money on your trade. You’ll also want to look for technical indicators like Bollinger Bands or moving averages that confirm the downtrend and provide additional confirmation before entering any trades. Remember that this pattern provides only one piece of evidence in your decision-making process and should be used along with other analysis methods as part of your broader trading strategy.

Disadvantages of Using a Death Cross Pattern

There are two major disadvantages to using this pattern for binary options trading. First, you’ll have to wait until the price breaks below the support level before taking any positions. Since it’s not always a precise indicator, you may miss out on some good entry points when the trend starts to move in your favour before breaking down into bearish territory. Secondly, there will also be times when false signals occur as traders buy into an asset once it breaks above its resistance level and then fails to keep its momentum going. This can result in significant losses if you don’t consider these factors before entering a trade.

So one more time, what is death cross in trading death cross is one of many technical analysis patterns that can be used for binary options trading. To be successful, you’ll need to combine it with other methods, such as Bollinger Bands and technical indicators, to improve your trading results. However, when used properly, this pattern can provide an edge that can help you find good entry points for short-term trades in any market.

The Best Time to Use the Death Cross Pattern for Binary Options Trading

When choosing a time frame for your binary options trade, you’ll need to consider the type of asset you want to trade and how long you plan to hold it before closing out your position. For example, suppose you’re trading stocks or indices. In that case, chances are that a longer-term expiry, such as one hour or four hours is more appropriate since these assets tend to move in either one direction or the other over time without much volatility. On the other hand, currencies and commodities tend to be more volatile, making them ideal choices for shorter-term trades, such as 60 seconds or five minutes. It’s also important to consider the current market conditions and how they relate to your chosen expiry time.

When trading binary options, there are no right or wrong choices when selecting a specific time frame for your trades. It all depends on what asset you’re trading and whether the price is trending upwards or downwards about its support and resistance levels.

However, it would be best if you never forgot that the death cross pattern is only useful in bearish markets. Any breakdown below a long-term support level will warrant using this method over any other technical indicator. But if an asset breaks back up through its resistance level without following through on its downward momentum after the crossover, consider waiting until it happens again before using this pattern.

To succeed when trading binary options, it’s important to keep your analysis simple by using only a few indicators to help identify good entry and exit points for your trades. This will allow you to make quick decisions based on the available information without taking on too much risk in any trade.

The death cross-trading pattern is a strategy that can be used by any trader to trade in the financial markets and achieve success successfully. The method involves identifying particular entry and exit points marked on a price chart. This allows traders to make accurate predictions about future market movements and avoid being caught out by sudden changes in price direction. In this article, we will look at the deas-trading pattern in more detail and show you how to spot it on your charts.

One of the key advantages of the death cross is its simplicity – there are only three steps involved in using it:

- Identify the trend: First, you need to identify a suitable trend for the death cross indicator to work on. The simplest way is to use a simple moving average (trend line) and observe how it relates to price action over time. In a bullish market, prices will be above the trendline; in bearish markets, they will be below it. So long as this relationship remains constant over some time – usually around thirty minutes or longer – this can indicate what kind of market we are dealing with.

- Establish support/resistance levels: Once you have identified that there is indeed a clear trend in place on your asset, you should then move on to identifying the support and resistance levels for that trend. These are the key areas where you will be looking to place your trades, so you must get them right.

- Enter a trade: Once you have identified the death cross pattern on your charts and the support/resistance levels are in place, you can enter a trade based on this signal. The first entry point will be at or close to the support level; once this has been breached, we can look to exit by placing an order above resistance (assuming it is reached).

The capital markets offer traders numerous ways of making money using technical analysis and charting patterns. There may be fewer indicators than in other financial markets. However, the death cross is still useful for any trader looking to place binary options trades in financial markets.

The beauty of this strategy is that it’s quite simple to understand and implement. This makes it an ideal choice for less experienced traders beginning their journey into binary options trading. However, there are some important things you should bear in mind before you begin using the death cross pattern:

– The pattern only works when prices trend downward (for downward crossovers) or upwards (for upward crossovers). If prices were not trending when the crossover occurred, this would be useless as a method of predicting future market movements. Of course, this will depend on what asset you are trading in, but the simpler a chart is to analyze, the better.

– Bear in mind that several other indicators can be used alongside this strategy to improve your chances of success. For example, using Bollinger Bands can help you understand whether there’s too much volatility and, therefore, the high risk involved with a given trade while also helping you avoid entering positions at the wrong time.

Bottom line

In conclusion, to use the death cross or any other technical indicator for success in binary options trading, you’ll need to develop a sound strategy and ensure that other factors support your analysis before entering any trades. The last thing you want to do when making trading decisions based on this method is to rely entirely on one piece of information while forgetting all the other factors contributing to an asset’s performance over time. However, by using multiple methods together, you can increase your chances of success over the long term with this market-tested pattern.