Open Property Group, renowned property experts, have released their latest research shedding light on the evolving landscape of UK homeowners and their relocation choices, with a notable surge of interest in Wales and the West Country.

Based on a comprehensive survey of 1.25 million homeowners, the study reveals that 39% of respondents are seeking a move to the countryside, where wildlife and nature have become “more important than ever” in their house-hunting endeavors.

Interestingly, since the pandemic, 49% of adults now spend more time outdoors than before COVID-19 struck, fostering an increased appreciation for natural surroundings.

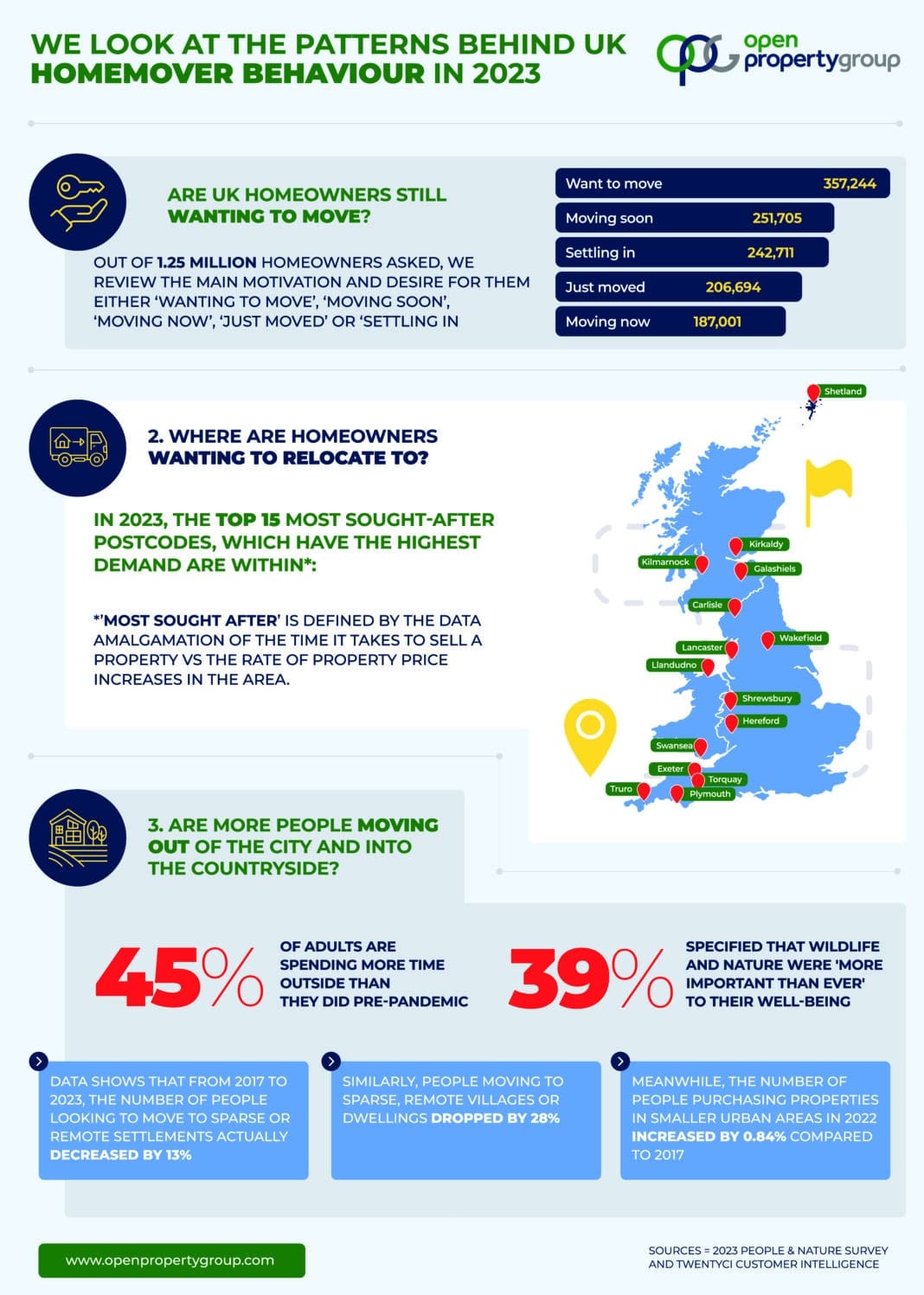

The survey further provides insights into homeowners’ moving plans:

- 357,244 individuals expressed their desire to move

- 251,705 homeowners stated that they are preparing to move imminently

- 242,711 reported they are settling into their new abodes

- 206,694 recently completed their house move

- 187,001 are in the process of moving at present

Despite this growing interest in rural living, recent data shows a 28% decline in people relocating to sparse or remote villages. Over the years, from 2017 to 2023, the number of homeowners contemplating a move to remote or sparse settlements has actually decreased by 13%.

Jason Harris-Cohen, the Managing Director of Open Property Group, observes, “The UK’s property market is experiencing a transformation.” He attributes the shift in moving activity to the surging popularity of the West of the country. Traditionally, buyers have sought better value for money outside London, the South East, and major cities, which has now fueled interest in Wales and the West coast.

Affordability has become paramount amid the cost of living crisis, and this desire is compounded by the current dynamics between inflation, the Bank of England base rate, and mortgage rates. While rates attached to new home loans and remortgages have tightened budgets, the strong desire to move remains. Homebuyers are adjusting their search criteria and preferences to accommodate these changing circumstances.

Semi-rural and rural locations are expected to remain more affordable than urban and inner-city areas, especially as people begin returning to offices for work, potentially leading to relocations that reduce commuting times and contribute to metropolitan house prices rebounding.

Despite the recent decline in rural living trends, there may be a surge in interest as buyers pursue attractively priced properties. The forecast suggests that borrowers might consider longer mortgage terms, such as 30-year mortgages or even interest-only mortgages, to offset the effects of higher repayment rates.

Jason points out, “A significant number of homeowners, 357,244 to be exact, are biding their time before making a move. They are awaiting favorable mortgage rates and a potential drop in house prices before progressing their plans.” In the meantime, many might opt to enhance their existing properties, improving their living environment while adding value. It is plausible that these delayed movers might contribute to a property market peak in late 2024 or early 2025.

With the housing landscape continuously evolving, the insights from property specialists shed light on the trends shaping the property market and homeowners’ decisions in the UK.